Audalia has developed two widely accepted products in the market from the Medcalf Project. The products include:

1. High Titanium Lump Ore; and

2. Concentrate Fine Ore

High Titanium Lump Ore

The production of pig iron in the iron making blast furnace is the most widely used method. It is a large scale industrial reactor that converts iron oxide to usable pig iron using coke and coal as fuel. It is well recognised that one of the main limitations of the furnace life is the wear of the hearth refractories.

There are several measures that can be undertaken to decrease the wear of the hearth refractory linings. A measure that has gained popularity since 1960’s is the addition of titanium bearing materials in the furnace by means of forming scaffolds along the surface of the eroded hearth linings. This scaffold is rich in titanium, has a high melting point and acts as a protection agent to prevent the eroded hearth lining from further damage.

The process of the titanium protection layer formation can be described as follows.

1. Dissolution of titania in slag phase.

2. Reduction of titania in slag phase and dissolution of produced titanium into hot metal phase.

3. Transport of titanium to the damaged refractory linings.

4. Formation of Ti(C, N) particles due to cooling.

5. Deposition of Ti(C, N) on the hearth walls and formation of scaffold.

Medcalf high titanium lump ore contains minimum Fe2O3 58%, TiO2 12.6% and V2O5 0.67%. The Medcalf ore only requires simple crushing and screening process to produce lump ore with the size of 10 – 60mm. The production of high titanium lump ore will be the first stage of Medcalf Project development.

Concentrate Fine Ore

The Medcalf ore with particle size smaller than 10mm or TiO2 grade below 12% will be stored onsite first. The stored ore will be beneficiated in the second development stage to produce a concentrate fine ore product.

The beneficiation process will consist of a comminution circuit and a magnetic or gravity separation circuit, which will remove the gangue materials, i.e. SiO2 and Al2O5. The concentrate will then be dewatered by thickening and filtration, with the filter cake stacked and prepared for transport. The tailings generated from the magnetic separation circuit will be thickened and stored in a tailings storage facility (TSF).

The concentrate fine ore can be processed by conventional blast furnace with vanadium extraction capability. The pig iron can be produced from the iron making blast furnace, and the vanadium is enriched into the slag. The vanadium can then be recovered from the slag during the steelmaking process.

Medcalf concentrate ore contains minimum TFe 52.3%, V2O5 0.81% and TiO2 13.6%.

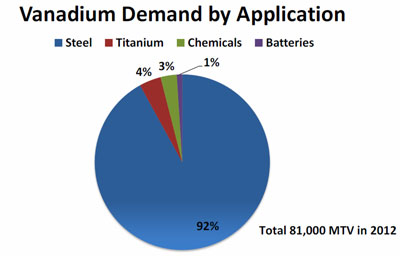

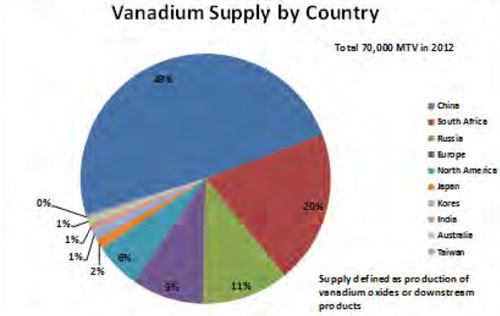

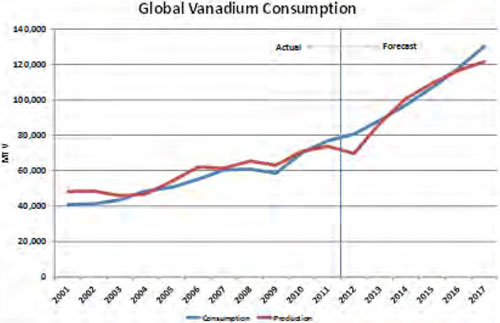

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

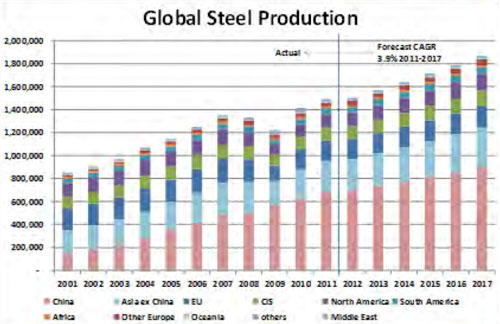

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012 Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

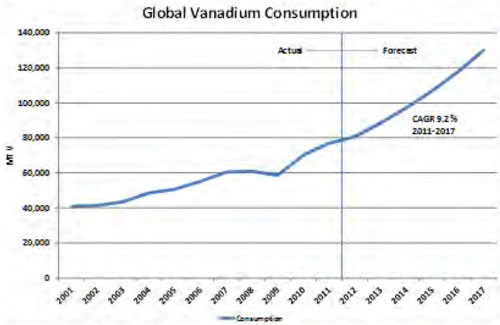

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

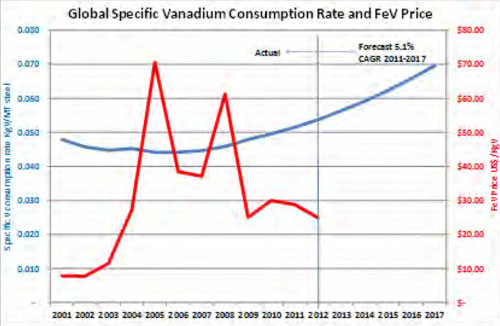

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012 Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012 Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012

Data source: Vanadium Market Fundamentals and Implications. Terry Perles/ TTP Squared, Inc., Nov. 13, 2012